Investing in EdLink

The following excerpt is from Allied’s original deal memo to investors. To review investment opportunities in full, please consider joining the syndicate at Allied.vc/join

Since the global pandemic began, we have seen dozens (if not hundreds) of edtech opportunities, and we’ve passed on 99% of them. Frankly, we’re not big fans of edtech, and with so many remote learning tools coming to market, it’s near impossible to determine which companies can generate meaningful & sustainable differentiation.

Instead of another remote learning tool, new curriculum or LMS, we have intentionally been on the lookout for a company that has positioned itself as core infrastructure for the industry as a whole. Just as AWS provides the necessary infrastructure for millions of businesses and is one of the last line items to get cut, we’ve been looking for a company whose services get written directly into COGS, coupled with a usage-based Enterprise SaaS model that scales as clients grow.

Enter EdLink

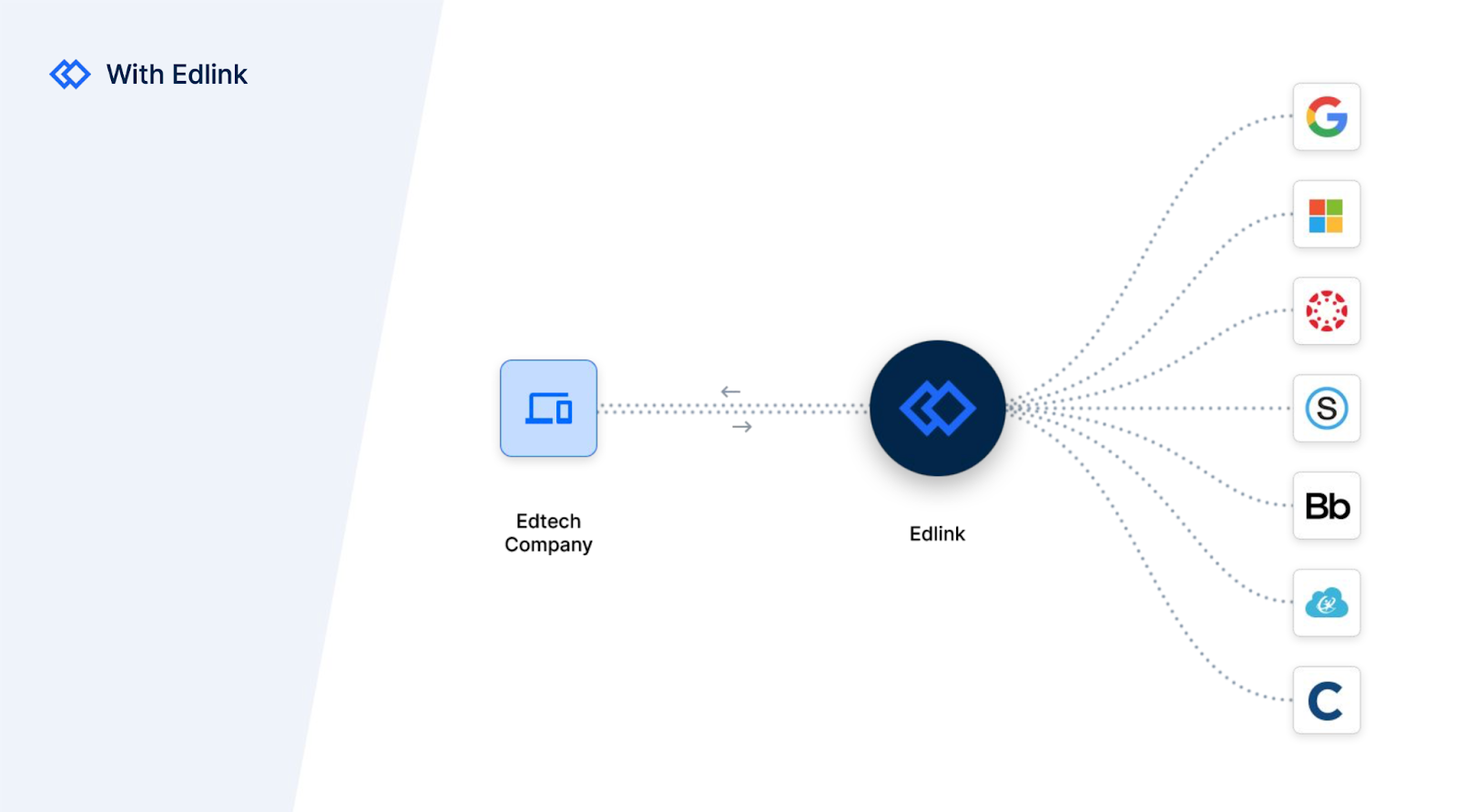

EdLink enables any edtech company to seamlessly integrate with every major LMS, at scale.

For example, from K-12 to post-secondary, nearly every educational institution now uses some type of Learning Management System (LMS) and/or Student Information System (SIS) to manage students, provide curriculum, and deliver grades.

On the other side of the table, thousands of edtech vendors provide schools with everything from classroom engagement tools, test prep, course & study materials, early childhood education, and career development services (among others).

However, there is no one-size-fits-all with more than 130,000 K-12 schools across North America, another 4,000+ post-secondary institutions, and an estimated 800 LMS/SIS services. Instead, schools employ a wide variety of edtech providers to deliver content and materials.

For the thousands of edtech companies globally (2,300+ in the US alone), each new customer (i.e. school) requires the company to build and maintain integrations into the school’s existing systems––a process which involves the hiring of more developers, thus costing money and consuming valuable time.

As a result, edtech companies are limited in their ability to go to market efficiently, quickly onboard new schools and subsequently scale.

With EdLink’s monthly enterprise SaaS subscription, edtech companies benefit from EdLink already having integrations with the top LMS and SIS providers across North America, representing a combined 85%+ market coverage.

Similar to how Zapier ($4B) enables users to integrate across various web applications, the EdLink API allows schools and edtech vendors to build complex integrations with little or no technical expertise, increasing the value of each application by ensuring they all work seamlessly together.

EdLink’s long-term vision is to become the backbone infrastructure for educational data.

Why we are thrilled to support Dakota, Amanda and the team at EdLink

As previously mentioned, we are not big fans of edtech in general. Since the onset of the global pandemic, we have witnessed a surge in edtech companies coming to market with new ways of remote learning, from K-12 to post-secondary, and corporate e-learning programs.

Additionally, VC funding for edtech startups in 2021 reached 3x pre-pandemic levels, surpassing $20B globally (source: HolonIQ).

Needless to say, while there has been much innovation and popularity within the edtech industry over the past 24-months, we have sat predominantly on the sidelines, unable to identify a meaningful and sustainable competitive edge among many of these recent market entrants.

Rather than attempting to pick a breakout winner, we chose to develop a broader, macro-level investment thesis to identify those companies that do not have to compete at the institutional level (i.e. selling into schools). Instead, we prefer to identify companies we believe can enable access and provide the core infrastructure for the entire industry.

When we met the team at EdLink and uncovered the various challenges within the edtech industry, the value of what they are building became very apparent to us. For instance, the issue of quick, developer-light and reliable integrations kept coming up across all stages of learning, including K-12, post-secondary and corporates.

Furthermore, given the team’s diverse industry expertise coupled with their ability to build products, sell, and expand ACV among high-value enterprise customers, they immediately stood out as the types of talented entrepreneurs we love backing.

1) Timing: Rapidly Expanding Market Opportunity

As highlighted above, it’s very challenging to identify a breakout winner among the thousands of new edtech startups which have come to market over the past 24-months. However, we can identify the sheer size of the edtech market and the velocity at which it is growing.

For example, the global edtech market is expected to grow at a CAGR of 19.4%, reaching ~$288B by 2027.

Source: Research and Markets

Furthermore, North America (Edlink’s initial target market) accounts for the highest market share of global edtech at 37% (i.e. ~$37B in 2021), with K-12 owning 41% market share (source: Grand View Research).

Lastly, there are approximately 7.2k edtech companies globally, 2.3k of which are US-based.

Therefore, given the broad applicability of EdLink’s API solution across all education levels, we believe EdLink is at a critical inflection point to quickly capture market share within this very large and rapidly-expanding target market.

2) Team & Execution: Proven Ability to Execute & Deep Domain Expertise

EdLink co-founders Dakota Gordon and Amanda Goodson have built a powerhouse team of highly-complementary skill sets.

For instance, Dakota has spent the past 10-years as a software engineer and entrepreneur, having previously founded the edtech company Atlas Learning in 2011––a successful publishing platform for educational content creators, teachers and schools.

Amanda has spent the past 10-years specializing in corporate business development, marketing and customer acquisition. She led teams and was responsible for sales at numerous organizations across the US and UK, including AIESEC––one of the largest international talent recruitment organizations for enterprises, NGOs and startups.

Amanda met Dakota when she joined Atlas Learning as Head of Growth in 2019, subsequently doubling the company’s MRR in her first 14-months. She’s an innate salesperson, to say the least––her first-ever job was selling educational textbooks door-to-door, and she led her region in sales.

While working with edtech clients at Atlas, Dakota and Amanda spent 80% of their time writing integrations with LMS and school systems. Therefore, they spun out EdLink as a dedicated integration platform and quickly discovered the immense popularity of this new platform.

Rounding out the team are software developers Anthony MacKay and Chris McLain, along with Jordan Clark (Head of Customer Success) and Sara Paolozzi (Client Success Manager). Combined, this team has worked across a wide range of enterprises, from startups to Fortune 500s, including General Motors, Ford and Visa.

Together, we believe this team’s domain expertise and complementary skill sets make them the absolute best people to continue building and capturing market share within the rapidly-expanding edtech market.

Certain information contained in this post has been obtained from third-party sources, including from portfolio companies of Allied Venture Partners. While taken from sources believed to be reliable, AlliedVP has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; AlliedVP has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by AlliedVP. (An offering to invest in an AlliedVP fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by AlliedVP, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.